Read “Trump Treasury pick Steven Mnuchin has a ‘widow foreclosure’ problem” at CNN Money, and “Steve Mnuchin: Evictor, Forecloser, and Our New Treasury Secretary” at American Prospect.

From the American Prospect:

Throughout his presidential campaign, Donald Trump criticized Wall Street bankers for their excessive political influence and attacked hedge-fund managers for getting away with “murder” under the current tax code. “The hedge-fund guys didn’t build this country,” Trump said on Face the Nation. “These are guys that shift paper around and they get lucky.”

Now, however, Trump has tapped Steve Mnuchin, a 53-year-old Wall Street hedge-fund and banking mogul—and, since May, his campaign-finance chair—to be the nation’s secretary of the Treasury.

Trump’s earlier rhetoric aside, it’s actually a good match. Both Trump and Mnuchin earned their first fortunes the old fashion way: They inherited them. Trump took over his father Fred’s real-estate empire and expanded it through questionable business practices. Mnuchin, also the scion of a wealthy and well-connected family, graduated from Yale in 1985, started his career as a trainee at Salomon Brothers and soon wound up working at Goldman Sachs, where his father Robert had been a general partner.

Both Trump and Mnuchin have run businesses accused of widespread racial discrimination and other predatory practices. They both represent the excessive wealth and greed of the billionaire developer and banker class. And both men have hedged their political bets, donating big bucks to Democrats as well as Republicans.

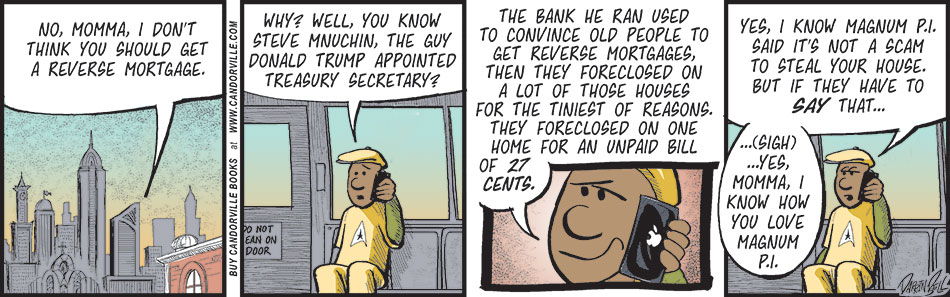

While Mnuchin ran OneWest Bank, based in Pasadena, California, the lender engaged in a variety of predatory practices that government bank regulators scrutinized and trial judges condemned. As Treasury secretary, Mnuchin would no doubt be one of the Trump administration’s key advisors in trying to dismantle the 2010 Dodd-Frank law strengthening regulations on the financial industry, including the Consumer Financial Protection Bureau, which in its short life has already protected hundreds of thousands of consumers from bank abuse.

…Under Mnuchin’s leadership, OneWest engaged in a laundry list of predatory practices, including robo-signing and peddling reverse mortgages to senior citizens.